Everyone knows they need to experience personal growth but most feel absolutely incapable of planning their way towards it.

The inability of the general population to plan what to do is evident, and it is not that uncommon. Out of the 500 people throughout the US were the sample for this survey, it was found that after the gift purchasing during the holiday season, nearly half the people had less than $1000 to their name.

Imagine!

What would they do if there was an emergency?

You do not want to spend the best years of your life in a mess like this. There is a dangerous trend among young people shown which is catching up.

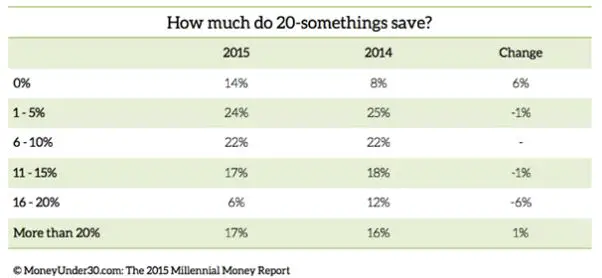

The savings rate amongst young people is dropping as the amount of people saving absolutely nothing has almost doubled in the past year. Young adults across the board are saving less with only a small one percent increase in the people saving more than 20 percent of their incomes.

1. But I don't have any responsibilities right now!

This is the first argument used by twenty-somethings to justify their frisky lifestyles. A lot of them feel like it's their right to have fun without worrying about expenses.

To a certain extent that is true, however this should not be done at the cost of responsibility. In fact, living like this might actually be detrimental to your health.

Living paycheck-to-paycheck might create unnecessary stress in your life. In 2014 Time Magazine reported a study by the Corporation for Enterprise Development (CFED) which found that roughly half of all Americans are living this way.

In my 20s I wish I knew that the best advice for any person is to follow their passion as opposed to chasing money. I’ve seen time and time again that the people who foster their true passions and true callings are the ones that end up the most successful.

The same study also reported that roughly 44% of all Americans are living with less than $5887 in their bank accounts. The CFED calls these folks “liquid asset poor”, and roughly a quarter of the American middle class falls in this category.

How do these people cope with emergencies? These households resort to borrowing for all unforeseen expenditure, from a car breakdown to a medical emergency, credit is integral to their survival.

Your 20's are a crucial time to start building wealth, because the compounding power of time is on your side.

2. You need to fear the Fear of Missing Out

Most of your expenditure in your twenties will be with your friends, whether it is a weekend getaway or a night out in town. It is important to understand what is motivating you to spend so much time and money with them.

Although you may reject the concept of peer pressure as high school antiques, once you start down that path it becomes very hard to control your spending as your friends too consistently expect you to live a certain lifestyle.

Sounds a lot more like peer pressure now, doesn’t it?

FOMO shapes the need for you to attend every party, be a part of every road trip and be present at every activity with your friends. It is a state of constant fear that each outing is going to be that one epic once in a lifetime experience.

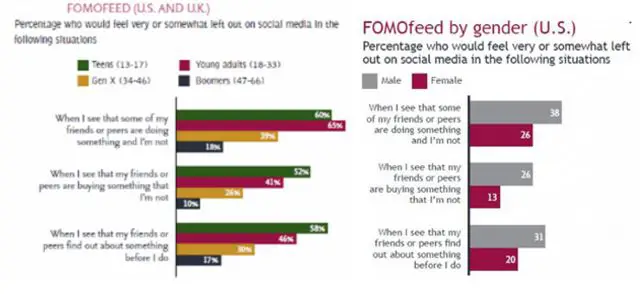

This survey amongst 762 individuals in the US and the UK found some interesting manifestations of the FOMO.

As you can see young adults are most affected by the first category, the same study also found that males are more affected than females by FOMO in all forms.

If you think you need to go out to every weekend with your friends, join in every activity, beware that constantly going out is likely to add up and take its toll.

Be realistic about how you use your time and your resources. You should not end up neglecting opportunities to improve your professional or private life as a whole.

3. De-clutter your life for your own good

Usually as you continue to live independently, you will develop a lifestyle which will be based on a routine of expenditure. On the face of it, you may think it is impossible to cut back on expenditure simply by looking at your empty bank account by the end of every month.

However on closer examination there is always clutter than can be eliminated from your life.

Collect together things you rarely use and will probably never use again. Sell them off. This will net you some cash and make your home more enjoyable.

Engage in community service. It's a way to spend an afternoon without spending money. It is also proven to make you feel good about yourself, by raising your self-esteem and hence making you more resistant to other urges and cravings.

Also rather than going out, consider throwing house parties where everyone in attendance contributes. This will allow you to hang out with your friends and have a good time at a much lower cost.

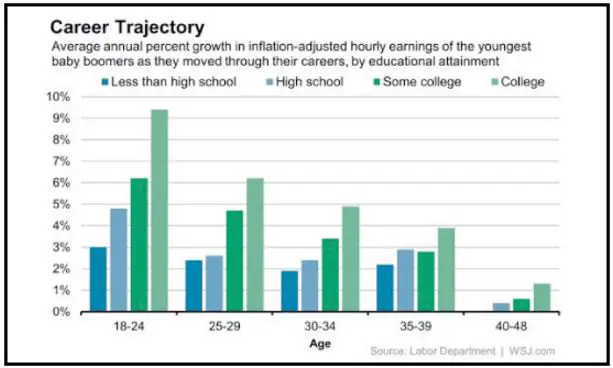

I was fortunate to have been raised with a strong sense of the importance of saving and living below your means. However, it wasn’t until later that I learned just how much of your long-term economic success depends on your professional career.

In your twenties, your biggest chunk of expenditure is probably your rent.

Consider some options like getting an additional roommate or perhaps moving altogether. An increasing number of millennials are moving back in with their parents, about 34 percent according to a survey by Pew Research Center.

Although parents may make for tough roommates, you won't find a more cost effective living situation.

As your income increases you might be inclined to spend more, after all it was you who earned the raise. However, this is a trap known as lifestyle creep. The greatest income rises are experienced by twenty and thirty year olds.

However, after that the growth begins to taper off. This is when you should be most wary of a “lifestyle creep”; the sustained rise of expenditure along with income, leaving little for savings.

You need to budget your life with a gradual rise in expenditure that you know you can sustain.

4. Why not give a shot at investing?

Twenty three year old Tim Grittani took a crash course in investing. He spent the next few months learning how to trade stocks. The brokerage account he wanted to use required a minimum of $12,500, but he didn’t have that much money. So he reached out to his friends and family and borrowed the difference.

But there was one big stipulation that his friends and family gave him…

Tim wouldn’t able to trade with the borrowed money. The money had to sit in the account. He was only to trade with his portion of the money, which was $1,500 at the time.

Because of his limited capital, he decided that he was going to focus on buying penny stocks.

Within the first six months, he made over $40,000. At one point, he made $11,000 in 15 minutes. He bought the stock AGRT at 40 cents and sold it at 70 cents… all within 15 minutes.

Over the next 12 months, Tim was on track to making even more money… $250,000 in profit.

Inspiring story, isn't it?

5. How does your emergency fund stack up?

If you were to face a rainy day, do you have the resources to cope?

A survey by the US Federal Reserve stated that the number of people who have saved has been halved since 2008.

Specifically among those who had savings prior to 2008, 57% said they had used up some or all of their savings since the 2008 recession. Only 39% reported having adequate funds to cover three months of expenses.

In my 20s, I wish I better understood the power of investing. At the time, I had fewer expenses, more free time, and a long investment horizon — it would have been the perfect time to learn about investing. While I was disciplined about saving money, I missed the opportunity to leverage my money over the long haul

Get life insurance. Look into 10 to 15 year plans at the start of your career as these can easily be upgraded to 30 year plans with much better deals from the banks if the need arises.

It's never too early to save money.

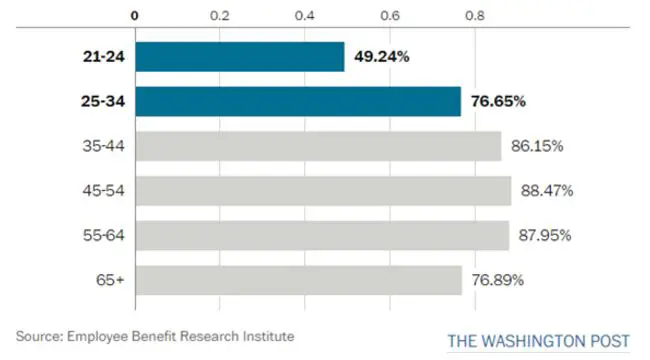

The following graph shows that young workers are less likely to participate in their company's' retirement plans, even when there is one available to them. This is unfortunate because a few hundred dollars saved today can turn into thousands in your future.

While investing in your 20's is risky, it's at a time of life when you need the growth and can handle the risk.

6. The power of positive thinking

At the end of the day while it is important to remain cautious about the future - you must not let negativity seep into your mental state.

Your thoughts create your feelings, your feelings create your actions, and your actions create your life. They’re all interconnected, no exceptions. The law of attraction states that thinking positive can change your life and it helps things work out in a positive manner.

Your body language is another aspect of your identity that you must strive to maintain. A great deal of how you communicate can be reflected quite accurately by your body language. Therefore, be more aware of your body language and really understand it.

Conclusion

There are hundreds of different situations and scenarios that twenty something’s face, but they all have one thing in common: they do not have things figured out.

At the end of the day you must also come to appreciate an existence of a certain level of uncertainty in your life that is not going to ever disappear. Your twenties will be a time of many successes and many failures. You are likely to be just out of school, searching for careers, and eager to find a foothold in society.

It is important that at this time you cultivate habits that will make or break your life. Planning ahead is a very important one, one that is not to be neglected.

Investing, cutting costs and better planning - what else can you do to improve your financial situation today?